Obamacare has been receiving plenty of criticism due to accusations that the health care law will hurt employees by eliminating positions or reducing hours to part-time. While the actual effects are still relatively unknown, staffing recruiters and HR professionals are confident that Obamacare will help drive job growth in certain areas.

Since PRN Funding works with numerous healthcare staffing companies, let’s take a look at the positions that are prepping for fast growth in the healthcare realm.

1. Nurse practitioners and physician assistants

Due to an increased demand for routine checkups and preventative medicine, physician services are set to increase at least 2 to 3 percent by next year. Nurse practitioners and physician assistants can perform similar services for the fraction of the cost of a doctor. Not to mention, general physicians are still in short supply and take much longer to enter the workforce. The Bureau of Labor Statistics (BLS) predicts the demand for PA’s will swell by 30 percent and staffing for registered nurses will increase 26 percent by 2020.

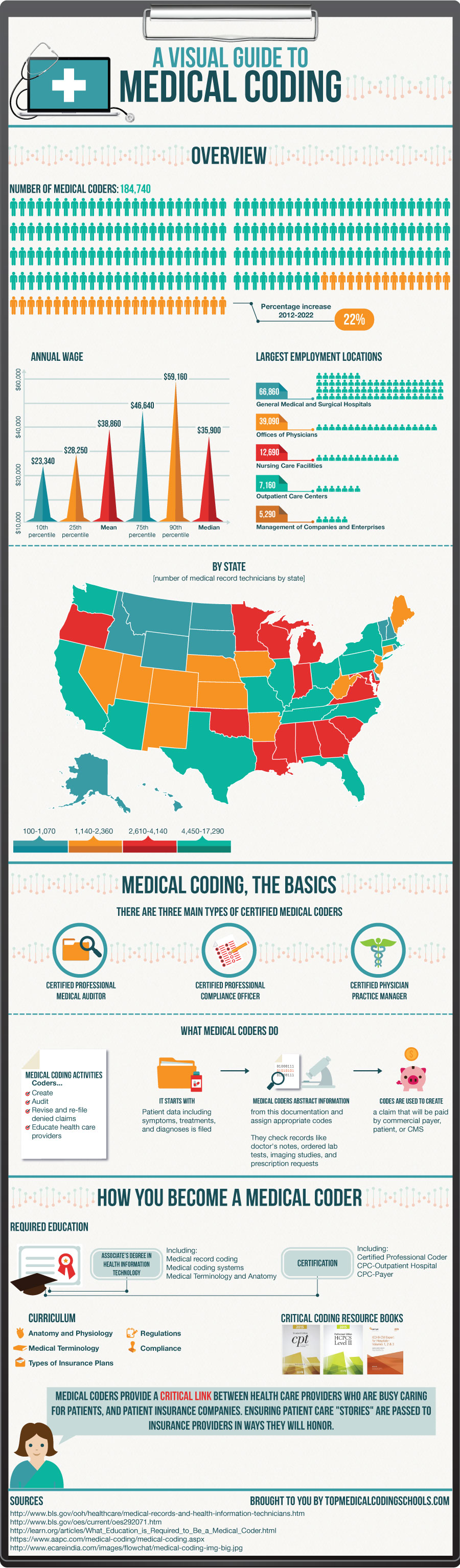

2. Medical billing coders

Healthcare IT staffing will be huge. Combine the requirements for healthcare facilities to transition to electronic health records and comply with a new medical coding system (ICD-10) with millions of newly insured patients and you have a recipe for lots of jobs to fill.

The International Classification of Diseases (ICD-10) will include a staggering 69,000 diagnostic codes and physicians will be required to submit claims with the new codes starting Oct. 1, 2014 if they want to get paid. Lots of healthcare IT staffing will be necessary to build these codes into the electronic health records software. According to Staffing Industry Analysts, medical coding is one of the hottest jobs right now.

3. Occupational therapists

Occupational therapists make appropriate modifications to the homes and workplaces of the disabled to accommodate their mobility needs. Since Obamacare prohibits insurance companies from denying coverage, more disabled people will be able to take advantage of health insurance coverage. The BLS forecasts a 43 percent spike in occupational therapy employment by 2020.

4. Wellness and fitness coaching

The need for health education specialists is expected to rise by 37 percent in 2020, according to the BLS. Many employers will want to encourage healthy lifestyles, so the demand for workplace wellness programs will skyrocket.

Aside from healthcare staffing, Obamacare is also expected to help spur career growth for payroll service providers, computer programmers, lawyers, insurance consultants, customer service reps and human resources professionals.